America Saves Week is Feb.19-26, a week dedicated to emphasizing the importance of teaching kids about money and savings by letting them interact with money and taking them to the bank to learn about transactions.

Talking about money—even among adults—can make things a bit uncomfortable. But, teaching kids about the value of money and best practices when it comes to saving and budgeting are vital to their long-term success.

Talking about money—even among adults—can make things a bit uncomfortable. But, teaching kids about the value of money and best practices when it comes to saving and budgeting are vital to their long-term success.

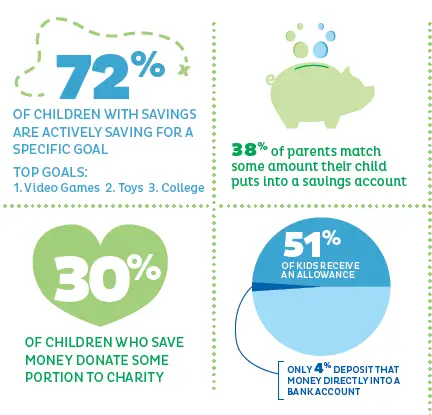

America Saves Week (Feb. 19-26, 2012) emphasizes the importance of teaching kids and teens about saving money. Recently, DoughMain, a free financial education and family organization website, conducted a survey of 2,000 parents to learn how kids interact with money in their everyday lives.

The study found that 81 percent of parents feel it is their responsibility to teach their kids about money and savings, but 63 percent of parents shared their kids had a savings account while 27 percent of parents said they take their kids to a physical bank to make an account transaction at least once a month. Also, 51 percent of kids receive an allowance, but only four percent of them put that money directly into a savings account.

“This research exposes that while parents to to be the primary finance teachers to their children, they’re just not doing it to the degree that’s going to make a difference for the next generation,” says Ken Damato, the president and CEO of DoughMain. “Things as basis as opening a savings account or how to read a bank statement are just not being taught in the classroom, leaving parents to be the primary educators about finacnes, and they need solid, credible, simple resources upon which to rely.”

*The National Survey of 2,034 adults with kids (age 4-18) was conducted online by Touchstone Reserach between Feb. 6-13, 2012. Courtesy DoughMain.

To learn more about how to teach kids and teens about money and saving, visit doughmain.com/savings.

Read more:

How to Teach Kids About Money Management

Allowance: How Much is Too Much?

5 Tips to Raising a Money-Smart Kid

Study: Women Lose More Sleep Over Finances Than Men